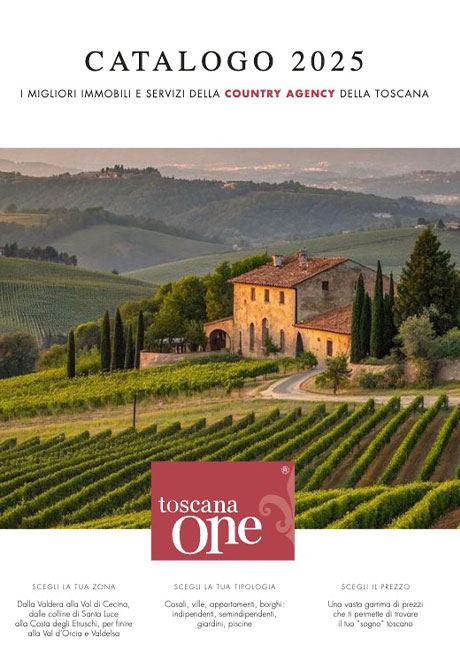

PURCHASER’S GUIDE

FOR A PROPERTY IN ITALY

Browse the complete guide

SEARCHING FOR THE RIGHT PROPERTY

The real estate market offers various property choices for sale in Tuscany, so the real challenge is finding the one that meets your needs. A home is not simply a building with rooms, it's the perfect place to relax and spend quality time with your loved ones. Having clear ideas allows you to save time and be satisfied.

BUYING A HOUSE IN ITALY: THE PURCHASE PROCEDURE TO FOLLOW

Let's see, in practical terms, what the correct procedure is to arrive at the purchase of the property.

A) PURCHASE OFFER

When deciding to purchase a house, once you have chosen a property from the many offered for sale, it is necessary to submit a purchase offer. The purchase offer is an irrevocable offer that contains the main terms of the transaction between seller and buyer. We refer in particular to the following elements:

- Names and surnames of the parties

- Date and place of birth

- Description of the property

- Land Registry data

- Agreed-upon price

- Payment terms

- Amount of the earnest money, etc.

The purchase offer must be made in writing. The seller may accept or reject the offer depending on the circumstances.

B) CONCLUSION OF THE PRELIMINARY AGREEMENT

Once the purchase offer has been accepted, the next step is the preliminary sales agreement.

This is a pre-purchase agreement with which the buyer formally undertakes. In fact, the contract usually provides for the payment of a deposit usually ranging from 10% to 30% of the property's value.

The preliminary contract must be drafted in writing and should contain all the conditions established by the parties in the purchase offer.

Essentially, its purpose is to oblige the parties to transfer ownership of the property within a certain timeframe. In cases with tight timeline, the conclusion of the preliminary contract can be avoided by directly concluding the deed.

C) CONCLUSION OF THE FINAL DEED OF SALE

The final contract of sale is the notarial deed. It is a document drawn up in the presence of a notary who, after reading it and inviting the parties to sign the document, proceeds with the usual transcriptions. The notary, as a public official, is required to transfer the information related to the sale and purchase to the relevant government authorities and to the Land Registry Office for the purpose of registration.

PURCHASE OF RESIDENTIAL PROPERTIES: COSTS

TAX IDENTIFICATION NUMBER (Tax Code)

To purchase a property in Italy, it is necessary to obtain a "TAX IDENTIFICATION NUMBER" (Codice Fiscale) through the Revenue Agency (INPS). Obtaining the Tax Identification Number is a service we provide to the client and is included in our commission. With the Tax Identification Number, you can purchase the property and also pay the applicable taxes.

STAMP DUTY

In accordance with the principle of alternativity between VAT and stamp duty, for the sale of residential properties by private individuals (without VAT registration number), stamp duty, as well as mortgage and cadastral taxes, are applied at the following rates:

- Fixed (€200 each) for sales subject to VAT.

- Proportional at 9% for sales exempt from VAT, or proportional at 2% if you are eligible for "first home" tax benefits.

VAT RATES

For the determination of the VAT rate to be paid, it should be noted that the sales of residential properties (not classified as luxury residences) by construction companies are subject to VAT at a rate of 4% if primary home and 10% if secondary home.

OTHER COSTS

- Notary’s estimate: € 3,500 + VAT

- Translation assistance: € 800 + VAT

- Brokerage fee (Real Estate Agency Fee):

- 3% + VAT for real estates over € 1,000,000

- 4% + VAT for real estates from € 201,000 up to € 1,000,000

- 5% + VAT for real estates from € 101,000 up to € 200,000

- € 5,500 + VAT for real estates from € 71,000 up to € 100,000

- € 4,500 + VAT for real estates from € 41,000 up to € 70,000

- € 4,000 + VAT for real estates from € 21,000 up to € 40,000

- € 2,000 + VAT for real estates from 0 up to € 20,000

*Vat in Italy is 22%

Download our guide now, where you can also learn about indirect taxes on property (IMU, TARI).

INDIRECT TAXES ON PROPERTY

PURCHASE IN ITALY

A foreign individual purchasing a house in Italy should be aware that in addition to paying indirect taxes on the purchase, they are also required to pay property taxes. These are taxes due simply for owning a real right to the property. Law no. 147/2013 consolidated all the originally envisaged indirect taxes on property under a single category known as IUC (Imposta Comunale Unica), which includes two taxes: IMU and TARI.

- IMU is the municipal property tax due by property owners, with the exception of primary non-luxury residences, for which it is not applicable.

- TARI is the waste tax imposed on individuals who effectively use the property, whether for a fee or free of charge.

The deadline for submitting the IUC declaration is June 30th of the year following the start of possession/occupation of the premises. Naturally, you will require the assistance of an experienced chartered accountant to manage these aspects. The average cost of this tax typically ranges from 0.50% to 0.70% of the actual property value at the time of acquisition.

CONDITIONS FOR BENEFITING FROM

FIRST HOME PURCHASE INCENTIVES IN ITALY

In order to benefit from the incentive associated with the purchase of a first home in Italy, the purchase must pertain to a property that:

- Is located in the municipality where the buyer already resides or intends to establish residency within 18 months.

The benefits may also be applied to the annexes of the dwelling, but with a limit of one for each of the cadastral categories C/2 (cellar or attic), C/6 (garage or parking space), and C/7 (closed or open shed). In addition to the property characteristics, the buyer must:

- Commit to establishing residency in the municipality where the purchased property is located within 18 months of the acquisition if they do not already reside there.

- Not be the exclusive owner or co-owner with their spouse of rights to ownership, usufruct, use, or habitation of another residential property within the municipality where the property to be purchased is located.

Both foreign citizens and those who have emigrated abroad can benefit from first home purchase incentives. It should be specified that taxpayers who do not have Italian citizenship can purchase with the first home relief if the requirements are met.